UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

__________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported)

__________________________________________________________

(Exact name of registrant as specified in its charter)

__________________________________________________________

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) | ||||||

(Address of principal executive offices and zip code) | ||||||||

( | ||||||||

(Registrant's telephone number, including area code) | ||||||||

__________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |||||

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |||||

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |||||

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |||||

Securities registered pursuant to Section 12(b) of the Act: | ||||||||

Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ý

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition

On August 10, 2023, The Oncology Institute, Inc. (the "Company") issued a slide presentation which includes the Company's financial results for the three months and six months ended June 30, 2023 and certain other financial information. A copy of the presentation is furnished hereto as Exhibit 99.1, which are incorporated by reference herein.

Item 7.01. Regulation FD Disclosure

On August 10, 2023, in conjunction with the slide presentation of its financial results, the Company provided updates regarding the Company’s business and guidance for the year ending December 31, 2023. The information provided above in “Item 2.02 - Results of Operations and Financial Condition” of this Current Report on Form 8-K (“Current Report”) is incorporated by reference into this Item 7.01.

The information contained in Items 2.02 and 7.01 of this Current Report and Exhibit 99.1 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section.

Item 9.01 - Financial Statements and Exhibits

(d) The following exhibits are being filed herewith:

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 10, 2023

The Oncology Institute, Inc. | |||||

By: | /s/ Mihir Shah | ||||

Name: | Mihir Shah | ||||

Title: | Chief Financial Officer | ||||

1THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Investor Presentation AUGUST 2023

2THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Disclaimer FORWARD LOOKING STATEMENTS This press release includes certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “preliminary,” “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “project,” “predict,” “potential,” “guidance,” “approximately,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding projections, anticipated financial results, estimates and forecasts of revenue and other financial and performance metrics and projections of market opportunity and expectations. These statements are based on various assumptions and on the current expectations of TOI and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by anyone as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of TOI. These forward-looking statements are subject to a number of risks and uncertainties, including the accuracy of the assumptions underlying the outlook discussed herein, the outcome of judicial and administrative proceedings to which TOI may become a party or governmental investigations to which TOI may become subject that could interrupt or limit TOI’s operations, result in adverse judgments, settlements or fines and create negative publicity; changes in TOI’s clients’ preferences, prospects and the competitive conditions prevailing in the healthcare sector; failure to continue to meet stock exchange listing standards; the impact of COVID-19 on TOI’s business; those factors discussed in the documents of TOI filed, or to be filed, with the SEC, including the Item 1A. "Risk Factors" section of TOI's Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 16, 2023 and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that TOI does not presently know or that TOI currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect TOI’s plans or forecasts of future events and views as of the date of this press release. TOI anticipates that subsequent events and developments will cause TOI’s assessments to change. TOI does not undertake any obligation to update any of these forward-looking statements. These forward-looking statements should not be relied upon as representing TOI’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements. FINANCIAL INFORMATION; NON-GAAP FINANCIAL MEASURES Some of the financial information and data contained in this press release, such as Adjusted EBITDA, have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). TOI believes that the use of Adjusted EBITDA provides an additional tool to assess operational performance and trends in, and in comparing our financial measures with, other similar companies, many of which present similar non-GAAP financial measures to investors. TOI’s non-GAAP financial measures may be different from non-GAAP financial measures used by other companies. The presentation of non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial measures determined in accordance with GAAP. The principal limitation of Adjusted EBITDA is that it excludes significant expenses and income that are required by GAAP to be recorded in TOI's financial statements. Because of the limitations of non-GAAP financial measures, you should consider the non-GAAP financial measures presented in this press release in conjunction with TOI’s financial statements and the related notes thereto. TOI defines Adjusted EBITDA as net (loss) income plus depreciation, amortization, interest, taxes, non-cash items, share-based compensation, goodwill impairment charges, change in fair value of liabilities, unrealized gains or losses on investments and other adjustments to add-back the following: consulting and legal fees related to acquisitions, one-time consulting and legal fees related to certain advisory projects, software implementations and debt or equity financings, severance expense and temporary labor and recruiting charges to build out our corporate infrastructure. A reconciliation of Adjusted EBITDA to net loss, the most comparable GAAP metric, is set forth below.

3THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Our technology platform is the first to standardize and align care delivery at scale, while proving our model with new market exportability. TOI’s future growth and new market entry is predictable, repeatable and scalable with tremendous near term and long-term growth opportunities in front of us. Oncology is a large and growing market but today’s care delivery system is broken and does not address quality and cost issues. TOI is the first mover disrupting oncology care with a unique value-based model. A unique value-based model disrupting Oncology Care

4THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Rising cost of Oncology Care is a massive problem in the U.S. of U.S. GDP is spent on healthcare and rising18% Healthcare is Unaffordable & Inefficient in the U.S. spent per person compared to OECD average2x Yet, U.S. incidence of chronic illness and longevity are worse than average estimated 2020 U.S. oncology spend+200$ BN CAGR for U.S. Oncology drug spending growth in the next four years11 –14% of U.S. adults have been diagnosed with cancer9.5% U.S. Oncology Spend Growth Continues to Accelerate Sources: Cancer Epidemiology, Biomarkers & Prevention –American Association For Cancer Research, July 2020; National Center for Health Statistics; IQVIA Institute; National Health Expenditure Data –CMS; Spending on Health: Latest Trends –OECD, June 2018. Oncology Care is a massive market with accelerating growth driven by misalignment, complex variable clinical pathways and high-cost drugs.

5THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Revenue(1) and Milestone Timeline TOI represents 0.01% of the U.S. Oncology Market providing substantial growth opportunity Notes: (1) 2007-2017 revenue is cash basis, unaudited and pertains to the Predecessor entity only (2) Predecessor revenue of $76M; Successor revenue of $37M (3) Represents Top End of 2023 Revenue Guidance $1 $10 $17 $26 $29 $38 $41 $42 $48 $64 $74 $113 $155 $188 $203 $252 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018(2) 2019 2020 2021 2022 TOI Founded, CA 1st Value-Based Contract Clinical Trials Established Downey & Whittier, CA Dispensary Opening Over 10K patients cared for TOI welcomed as first cohort of OCM participants Private Equity Investment Arizona Expansion AZ Dispensary Opening NV Expansion 1st Outpatient Stem Cell 1st Gainshare Contract 50th Clinic De-SPAC NV Dispensary Opening Florida Expansion Texas Expansion FL & CA Dispensary Opening $320 2023(3) 43.4% Revenue CAGR Revenue in Millions

6THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Disrupting the Status Quo in Cancer Care ✓ Incentivized by quality ✓ Incentivized to use high-value therapies ✓ Physician compensation model aligned to quality and patient satisfaction ✓ Practice tailored to address individualized patient needs ✓ Supported by patient and payors ✓ Aligned to support appropriate transitions to palliative and hospice care Our Disruptive Value-Based Oncology Care ✖ Incentivized by volume ✖ Incentivized to use high-cost therapies ✖ Physician compensation model aligned to high cost ✖ Practice tailored to profit ✖ Supported by drug manufacturers and distributors ✖ No incentives to utilize appropriate care transitions Today’s Traditional Fee-for-Service Oncology Care

7THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION unique patients treated each year~64K lives served under capitation~1.8M clinical trials giving patients cutting edge access170+ We are building the leading Value-Based Oncology Care Platform reduction in patient healthcare costs25%+ Revenue generated from value-based agreements in 2022>50% Members transitioned to TOI from other providers/payors>400K Key Partners

8THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Our results are peer-reviewed & published (1) Based on study on TOI patient population conducted by researchers at Stanford University; (2) As of April 11, 2021 (5.0 scale). Lower Inpatient Admissions(1)30% Improvement in Patient Satisfaction(2)14% Fewer Acute Care Facility Deaths(1)40% Fewer ER Visits in the Last Month of Life(1)75% Lower Median Total Healthcare Costs for Patients from Diagnosis to Death(1)> 25% TOI is highly effective in delivering quality, value-based oncology care

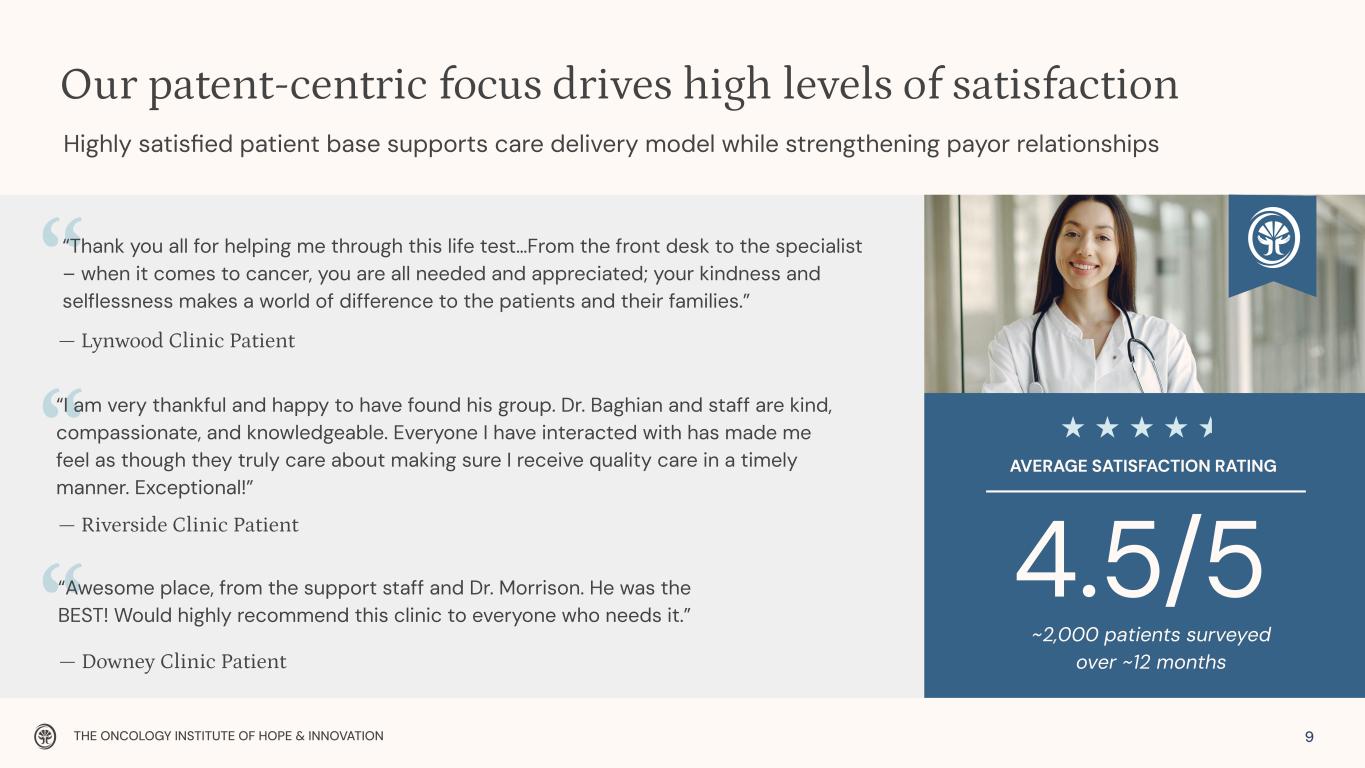

9THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION “ “ “ Our patent-centric focus drives high levels of satisfaction “Thank you all for helping me through this life test…From the front desk to the specialist – when it comes to cancer, you are all needed and appreciated; your kindness and selflessness makes a world of difference to the patients and their families.” — Lynwood Clinic Patient “Awesome place, from the support staff and Dr. Morrison. He was the BEST! Would highly recommend this clinic to everyone who needs it.” — Downey Clinic Patient “I am very thankful and happy to have found his group. Dr. Baghian and staff are kind, compassionate, and knowledgeable. Everyone I have interacted with has made me feel as though they truly care about making sure I receive quality care in a timely manner. Exceptional!” — Riverside Clinic Patient Highly satisfied patient base supports care delivery model while strengthening payor relationships ~2,000 patients surveyed over ~12 months 4.5/5 AVERAGE SATISFACTION RATING

10THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION We use multiple levers to reduce cost of care Effective Treatments • Reduce practice pattern variability • Access to clinical trials in the community • Vertical integration of dispensary and scaled drug purchasing High-Value Cancer Care Program • Algorithm driven action plan • 24/7 Health Care Coach • Patient education and engagement Palliative & Hospice Collaboration • Providers trained in advanced care planning • Close coordination between network providers

11THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Proven portability with a rapidly expanding footprint California Clinics 48 Florida Clinics 8 Arizona Clinics 4 Nevada Clinics 5 Texas Clinics 2

12THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Strong unit economics drives increasing profitability 10% 15% 20% 25% 30% 35% 40% 20% 30% 40% 50% 60% 70% 80% 90% Po d G ro ss M ar gi n Pod % Value-Based Visits ↑ ↑ TOI Pod(2): Gross Margin vs. % Value-Based Visits Embedded gross margin expansion potential as TOI scales As our mix of value-based revenue increases our margins are expected to improve; pods today with highest mix of value-based contract achieve 30%+ margins Value-Based Volume Mix: Margins expected to improve as Provider productivity increases in maturing clinics the ratio of APPs(1) to MDs increases. Provider Utilization: Certain expansion markets have higher-cost fee-for-service oncology, therefore we believe TOI can deliver better value and savings to our customers and capture higher margins. Market Dynamics: (1) Advanced Practice Providers (APPs) include Physician Assistants and Nurse Practitioners; (2) Each pod is an operational unit consisting of 2-5 clinics, grouped together based on geographic proximity and visit volume. This analysis was performed in 2020.

13THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Existing Markets Continue driving growth in lives and partnership expansion + New contracts + Expand covered lives + New clinics & providers + Improve unit economics + Medicare direct contracting New Markets Well-honed model enables quick scaling in new markets + Establish presence in new markets + Highly attractive market dynamics + Value-based care transition for physicians + Successful acquisition track record with a scalable platform Service Expansion Expand scope and diversify service offering + Build comprehensive portfolio of ancillary services + Radiation Oncology + Pharmacy + Clinical trials + MSO services + Data monetization Multiple levers to sustain long term growth trajectory TOI represents 0.01% of the U.S. Oncology Market providing substantial growth opportunity

14THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Financial Overview

15THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Diversified business model with multiple drivers of revenue growth and margin expansion + Medicaid + Medicare + Commercial Patient Care (Medical & Radiation Oncology) Drug Dispensing Clinical Trials Data Monetization Management Services Products Covered Revenue Model Geographic Diversity Clinics New VBC Contracts Productivity Multiple Levers to Drive Top Line Growth & Margin Expansion + Capitation (VBC) + Gainshare (VBC) + Fee-for-Service + Currently in five states + Varying degree of managed care adoption + Oncology provider landscape driving significant cost variation + Legacy / Same Store + Acquisition + De Novo + Capitation Contracts + Gainshare Contracts + MD Productivity + MD / APP Pairing + Technology & Process Excellence

16THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Value driven highly attractive economic model Payor Contracts Provider Contracts FFS Driven; High Cost for Payors and Risk-Taking Providers Unmanaged or Under-managed Oncology Market TOI saves payors 25%+ of medical oncology costs Pool of lives managed by TOI TOI captures a 20% –40% margin on contracts TOI Preferred / Exclusive Provider with Lower Cost Capitated Contracts TOI Delivers High Quality / Low-Cost Care MARGIN Full Risk Contract: TOI takes full upside and downside risk Gainshare: TOI receives portion of savings from payor / at risk provider partners Illustrative Economic Model

17THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION 2023 Guidance REVENUE $290 to $320 million representing approximately 15% to 27% growth over 2022 revenue GROSS PROFIT $60 to $70 million ADJUSTED EBITDA $(25) to $(28) million VALUE-BASED LIVES 1.75 to 2 million lives Note: TOI's achievement of the anticipated results is subject to risks and uncertainties, including those disclosed in its _lings with the U.S. Securities and Exchange Commission. The outlook does not take into account the impact of any unanticipated developments in the business or changes in the operating environment, nor does it take into account the impact of TOI's acquisitions, dispositions or financings during 2023. TOI's outlook assumes a largely reopened global market, which would be negatively impacted if closures or other restrictive measures persist or are reimplemented.

18THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Key Takeaways ✓ Early market leader in large & growing market ✓ Proven model with imbedded scalability ✓ Well capitalized, with disciplined deployment strategy ✓ Our platform growth enables high-quality, affordable care for more patients

19THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Historical Financials

20THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION Patient services $ 35,057 $ 39,109 $ 44,627 $ 47,992 $ 50,273 $ 53,426 $ 116,817 $ 124,074 $ 166,785 Dispensary 18,679 20,218 18,839 21,607 24,240 25,196 63,890 72,550 79,343 Clinical trials & other 1,425 1,594 1,511 1,825 1,679 1,602 6,808 6,379 6,355 Total operating revenue 55,161 60,921 64,977 71,424 76,192 80,224 187,515 203,003 252,483 Direct costs – patient services 27,378 32,875 36,126 38,382 42,814 44,878 95,747 99,401 134,761 Direct costs – dispensary 15,324 16,754 15,738 17,295 19,145 20,111 53,907 62,102 65,111 Direct costs – clinical trials & other 137 150 113 118 134 118 982 652 518 Goodwill impairment charges — — — 9,944 16,867 — — — 9,944 Selling, general and administrative expense 29,806 28,348 31,963 29,572 28,830 28,726 41,898 83,365 119,689 Depreciation and amortization 987 1,098 1,134 1,192 1,269 1,329 3,178 3,341 4,411 Total operating expenses 73,632 79,225 85,074 96,503 109,059 95,162 195,712 248,861 334,434 FOR YEAR ENDED Mar 31, 2022 FOR THREE MONTHS ENDED Jun 30, 2022 Sept 30, 2022 Dec 31, 2022 Mar 31, 2023 Jun 30, 2023 Dec 31, 2020 Dec 31, 2021 Dec 31, 2022 R EV EN U E O PE R A TI N G E X PE N SE S Historical Financials In thousands

21THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION FOR YEAR ENDED Mar 31, 2022 FOR THREE MONTHS ENDED Jun 30, 2022 Sept 30, 2022 Dec 31, 2022 Mar 31, 2023 Jun 30, 2023 Dec 31, 2020 Dec 31, 2021 Dec 31, 2022 IN C O M E (L O SS ) Loss from operations (18,471) (18,304) (20,097) (25,079) (32,867) (14,938) (8,197) (45,858) (81,951) Other non-operating expense (income) Interest expense, net 74 61 1,497 2,450 1,443 1,638 347 320 4,082 Change in fair value of derivative warrant liabilities 1,461 (2,065) 159,000 (1,398) (143) (118) — (3,686) (1,843) Change in fair value of earnout liabilities (39,440) (10,800) (3,581) (5,394) (752) (17) — (24,891) (59,215) Change in fair value of note embedded derivative liabilities — — (15,510) (8,690) (3,318) — — — (24,200) Gain on debt extinguishment (183) — — — — — — (4,957) (183) Other, net 151 (15) 36 (673) (143) 357 6,271 (1,046) (501) Total other non-operating income (37,937) (12,819) (17,399) (13,705) (2,913) 1,860 6,618 (34,260) (81,860) Income before provision for income (loss) taxes 19,466 (5,485) (2,698) (11,374) (29,954) (16,798) (14,815) (11,598) (91) Income tax (expense) benefit (180) 32 24 367 (44) (99) 493 671 243 Net income (loss) 19,286 (5,453) (2,674) (11,007) (29,998) (16,897) (14,322) (10,927) 152 Adjusted EBITDA (1) (5,184) (6,687) (6,680) (4,640) (7,929) (6,941) 5,773 (4,824) (23,542) Historical Financials Note: (1) Adjusted EBITDA is a non-GAAP measure. For a discussion and reconciliation to the nearest GAAP measure please see Slide 22 of this presentation In thousands

22THE ONCOLOGY INSTITUTE OF HOPE & INNOVATION FOR YEAR ENDED Mar 31, 2022 FOR THREE MONTHS ENDED Jun 30, 2022 Sept 30, 2022 Dec 31, 2022 Mar 31, 2023 Jun 30, 2023 Dec 31, 2020 Dec 31, 2021 Dec 31, 2022 Net (loss) income $ 19,286 $ (5,453) $ (2,674) $ (11,007) $ (29,998) $ (16,897) $ (14,322) $ (10,927) $ 152 Depreciation and amortization 987 1,098 1,134 1,192 1,269 1,329 3,178 3,341 4,411 Interest expense, net 74 61 1,497 2,450 1,443 1,638 347 320 4,082 Income tax expense (benefit) 180 (32) (24) (367) 44 99 (493) (671) (243) Board and management fees 45 62 64 — — — 620 553 — Non-cash addbacks 197 108 299 604 141 24 11,972 (5,115) 1,208 Share-based compensation 8,552 6,515 6,546 6,070 4,965 4,107 151 24,535 27,683 Goodwill impairment — — — 9,944 16,867 — 9,944 Change in fair value of liabilities (37,979) (12,865) (18,932) (15,482) (4,213) (135) — (28,577) (85,258) Unrealized (gains) losses on investments — — 33 (673) (143) 267 (640) Accretion of discount on investments — — Practice acquisition-related costs 422 111 166 91 16 55 374 476 790 Practice acquisition deferred purchase price — — 2,088 155 581 581 2,243 Consulting and legal fees 655 1,144 883 1,115 585 929 1,495 1,826 3,797 Other, net 953 1,634 1,239 1,204 506 1,042 2,451 1,692 5,030 Public company transaction costs 1,444 750 1,001 64 8 20 — 7,723 3,259 Adjusted EBITDA $ (5,184) $ (6,867) $ (6,680) $ (4,640) $ (7,929) $ (6,941) $ 5,773 $ (4,824) $ (23,542) Adjusted EBITDA Reconciliation The Company includes adjusted EBITDA because it is an important measure upon which our management uses to assess the results of operations, to evaluate factors and trends affecting the business, and to plan and forecast future periods. Adjusted EBITDA is “non-GAAP” financial measure within the meaning of Item 10 of Regulation S-K promulgated by the SEC. Management believes that this measure provides an additional way of viewing aspects of the Company's operations that, when viewed with the GAAP results, provides a more complete understanding of the Company's results of operations and the factors and trends affecting the business. However, non-GAAP financial measures should be considered a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with U.S. GAAP. Non-GAAP financial measures used by management may differ from the non-GAAP measures used by other companies, including the Company's competitors. Management encourages investors and others to review the Company's financial information in its entirety, not to rely on any single financial measure. In thousands